texas property tax lien loans

6331d or with the actual act of levy under 26 USC. TAX LIENS AND PERSONAL LIABILITY.

Tax Lien Investing Can You Make Good Money Women Who Money

Its easy to pay off your property taxes when you call Tax Ease.

. TAXABLE PROPERTY AND EXEMPTIONS. Local governments typically assess property tax and the property owner pays the tax. Unlike other types of tax liens the property tax lien is usually only attached to the property that has unpaid taxes.

A lien serves to guarantee an underlying obligation such as the repayment of a loan. The government issues a tax lien certificate when the lien is placed on the property. The effective property tax rate in Oregon is 090 while the US.

The TX car title certificate. By Texas law the maximum amount you can borrow with any Home Equity Loan or a Home Equity Line of Credit is 80 of your homes appraised value. Frost Home Equity Loan rates shown are for the 2nd lien position.

For Wall Street Journal WSJ Prime call 866-376-7889. My address is 4633 waterway drive north Ft. It generally means other property is safe from collection relating to the tax lien.

Pursuant to Texas Occupations Code chapter 1201206 g and Texas Property Tax Code section 3203 a-2 a person may not transfer ownership of a manufactured home until all recorded tax liens have been released and all taxes which accrued within the 18 months preceding the date of the sale have been paid. A lien is a legal right granted by the owner of property by a law or otherwise acquired by a creditor. In one sense thats good news.

For example whenever a lender provides funding for the borrower to buy a car house or other significant assets they place a lien on the property so that if the property owner defaults on the loan and doesnt pay the creditor back the financier can sell the property and collect their funds. Those who use bank loans to buy property but dont make their payments on time are subject to a personal lien. Property tax sometimes called an ad valorem tax is a tax on real estate and some other types of property.

How Tax Lien Loans Can Help. A On January 1 of each year a tax lien attaches to property to secure the payment of all taxes penalties and interest ultimately imposed for the year on the property whether or not the taxes are imposed. This is referred to as bonding off the lien.

Weve helped thousands of Texans. REAL AND TANGIBLE PERSONAL PROPERTY. However specific tax rates can vary drastically depending on the county in which you settle down.

Ask a Frost Banker for details. If you have an electronic title your lienholder will then simply remove the lien electronically and notify you once the lien release is complete. Average currently stands at 107.

If your vehicle has a paper title the lienholder must mail you. A property tax lien is a lien placed on real estate when the property taxes havent been paid. With three base locations in Dallas Houston and McAllen TX we provide hassle-free Texas property tax loans for residential or commercial property owners.

This doesnt eliminate the claim altogether. For mechanics liens in particular a lien bond can be a useful way to remove the lien from the property title. Removing a Lien from a TX Title.

Our tax lien loans are designed to help stop the fees and interest from piling up and make it easier for you to pay off what you owe. Weve helped thousands of Texans save time and money with Texas property tax loans. Worth Texas 76137.

This document includes details of the property the amount owed and any additional charges such as interest. When placed on a property a lien prevents the owner from selling their home until it is removed and the following information will help you search for lien records. TAXABLE PROPERTY AND EXEMPTIONS.

When a lien is filed a property owner can opt to discharge the lien by substituting a surety bond. The creation of a tax lien and the subsequent issuance of a Notice of Federal Tax Lien should not be confused with the issuance of a Notice of Intent to Levy under 26 USC. Rather it changes the collateral that is.

A All real and tangible personal property that this state has jurisdiction to tax is taxable unless exempt by law. The difference between a federal tax lien and an administrative levy. County Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate.

A lien is a legal claim over an asset held as collateral. If you need property tax help in Texas one solution that can alleviate the stress or potential embarrassment that stems from tax debt is a loan from Tax Ease. 1st lien products are available.

After receiving your last payment your lienholder will have 10 business days to release the lien. Oregon has property tax rates that are nearly in line with national averages.

What Are Tax Liens And How Do They Work The Pip Group

How To Find Tax Delinquent Properties In Your Area Rethority

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)

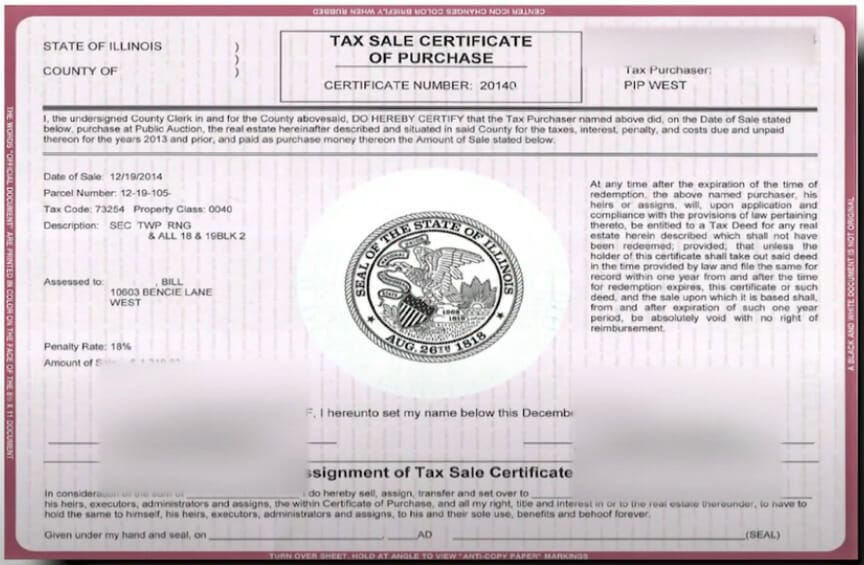

Tax Lien Certificate Definition

Unfair And Unpaid A Property Tax Money Machine Crushes Families Wealth Management

What Are The Different Types Of Property Liens

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

What Happens When Your House Goes Up For Auction Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

Property Tax How To Calculate Local Considerations

How To Find Tax Delinquent Properties In Your Area Rethority

Https Tedthomas Com Portfolio Video Is Texas A Tax Lien Or Tax Deed State Utm Campaign Linda Utm Source Social Media Every Tuesday Te Video State Tax Author

Tax Lien Sales Can You Buy Tax Lien Properties To Save Big

How Do I Know If There S A Lien On My Property Howstuffworks

Property Tax Lending Vs Tax Lien Transfers What S The Difference

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)